The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and most families will automatically receive monthly payments without having to take any action.

This is major tax relief for nearly all working families: $3,000 to $3,600 per year, per child (paid in automatic, monthly installments).

Employees who have filed tax returns for 2019 or 2020, or signed up to receive a stimulus check from the Internal Revenue Service, will be eligible to get this tax relief automatically.

Employees should not need to sign up or take any action.

But, if an employee hasn’t had to file income tax in 2019 or 2020, they can still sign up to get the Child Tax Credit:

They won’t lose their benefits if they sign up. These payments do not count as income for any family. So, signing up won’t affect their eligibility for other federal benefits like SNAP and WIC.

Employees can check to see if they are enrolled or opt out and unenroll to stop getting advance payments by going to the Child Tax Credit Update Portal. The portal also allows employees to provide or update their bank account information for monthly payments, starting with the August payment.

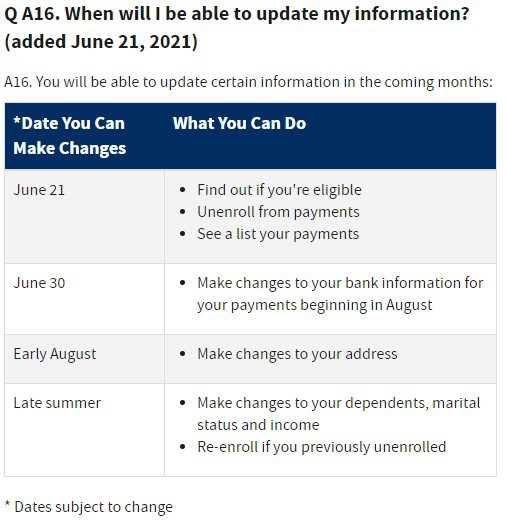

The portal will be going through many renovations over the summer. In the coming months employees will be able to make other updates that affect their payment noted on the table below.

Employees are also eligible to apply for the Recovery Rebate Credit, also known as stimulus payments, as part of this process.

Leave a Comment